New Zealand Energy Corp has updated its reserve and resource estimation and economic evaluation, resulting in a 97{87a03eb4327cd2ba79570dbcca4066c6d479b8f7279bafdb318e7183d82771cf} increase to 3P oil reserves and a 172{87a03eb4327cd2ba79570dbcca4066c6d479b8f7279bafdb318e7183d82771cf} increase to 3P natural gas reserves.

NZEC commissioned AJM Deloitte to prepare an interim reserve estimate and economic evaluation to include data from wells that commenced continuous production in 2012.

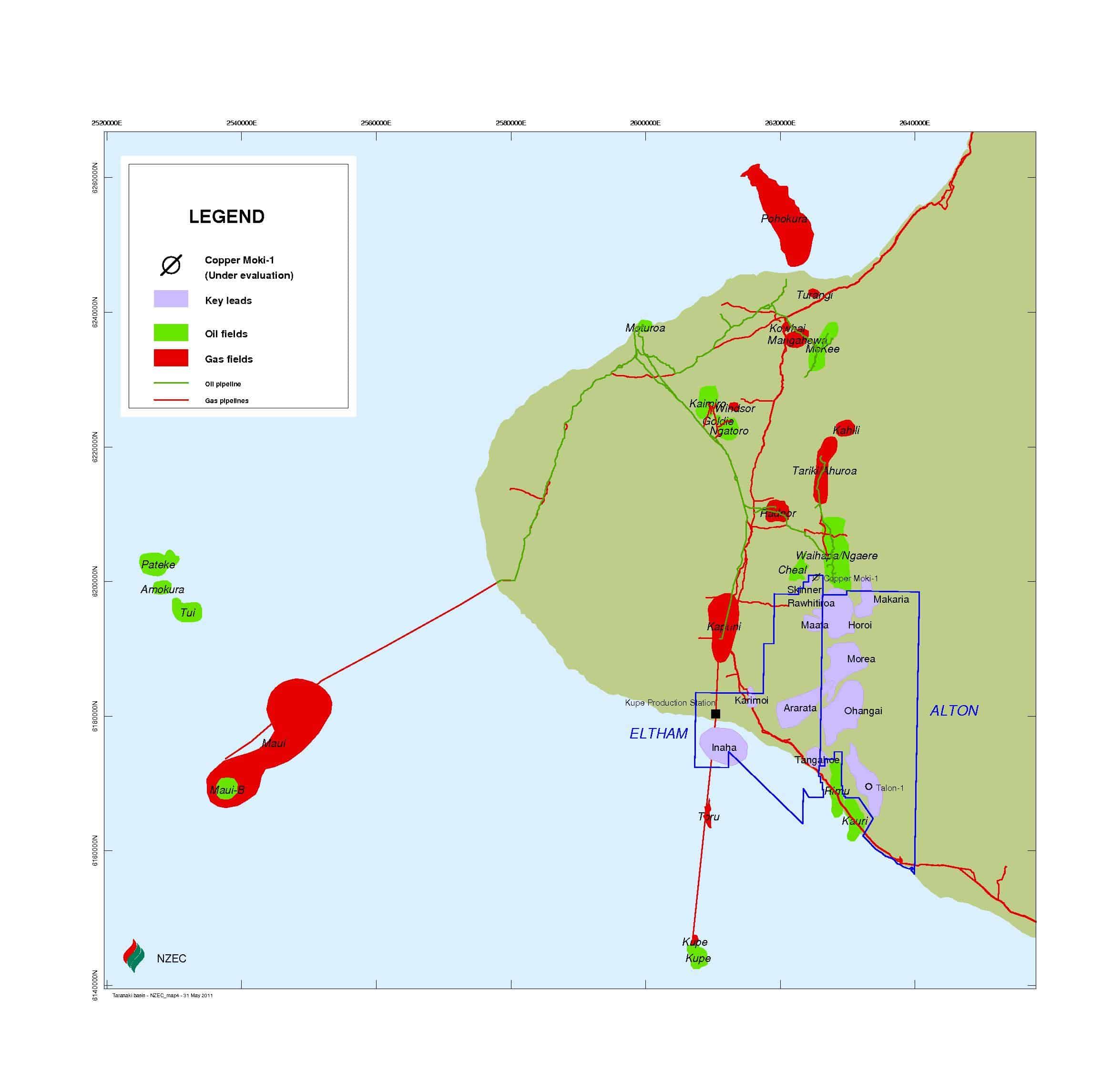

The interim reserve estimate and economic evaluation was confined to NZEC’s 100{87a03eb4327cd2ba79570dbcca4066c6d479b8f7279bafdb318e7183d82771cf} working interest Eltham Permit (PEP 51150) and based on reservoir and production data from the Copper Moki-1, Copper Moki-2 and Copper Moki-3 wells.

Daily production data were used to predict the production profiles and recovery factors. NZEC is currently installing artificial lift systems (pump jacks) on all three wells. AJM Deloitte forecast an increase in production rates under the proved undeveloped case to account for artificial lift. An updated reserve estimate, coinciding with NZEC’s financial year-end of December 31, will incorporate data from artificial lift production rates.

AJM Deloitte also reviewed the seismic mapping presented by NZEC and agrees that this data is likely indicative of the higher permeability regions targeted by the wells but is not conclusive relative to the total extent of the reservoirs.

NZEC is an oil and natural gas company engaged in the production, development and exploration of petroleum and natural gas assets in New Zealand. NZEC’s property portfolio collectively covers approximately 2.25 million acres (including pending permits) of conventional and unconventional prospects in the Taranaki Basin and East Coast Basin of New Zealand’s North Island.